![]()

![]()

France presents a long tradition of buying by catalogwith powers like La Redoute or Veepee, so the transition to eCommerce has been relatively easy. 80% of internet users in France also shop online, which is a juicy market for 41.8 million people and more than 2.1 billion transactions made in 2021. eCommerce sales accounted for 14.1% of total retail sales in France last year.

According to the data presented by Fevad (Fédération du e-commerce et de la vente à distance), the e-commerce sales in France exceeded 129,000 million euros in 2021. These sales were distributed fairly evenly between services (62.3 billion) and products (66.7 billion).

And, as a whole, online sales grew by 15.1% compared to 2020. These figures place France as the second largest electronics market in Europe, behind only the United Kingdom.

How the French buy

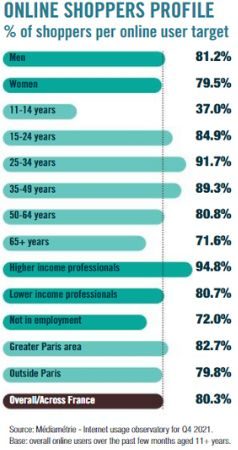

In France, those who buy the most are people between 25 and 34 years oldthat is, the so-called young millennials (91.7%). Likewise, the profile of the average buyer would be completed with the following characteristics: high level of income, male, and resident of the area called Greater Paris.

The behavior of French consumers bears certain similarities with that of the Spanish: like us, they make most of their purchases from a computer (78%) and the mobile phone is gaining weight as a purchasing device (59%). Results that, in turn, contrast with those of the United Kingdom, where the smartphone is the leading purchasing device.

The previous year, the French spent on their online purchases €3,100 on average per buyerpresenting a average ticket of €60 (0.8% less than in 2020). As for the payment methodsthe most popular among online consumers are the credit cards (77%), followed by ewallets (40%). Likewise, solutions such as “buy now, pay later” are gaining strength.

Regarding your preferences regarding the delivery of orders, the vast majority prefer to have their orders delivered to their homes (80%)while 67% opted for collection points and 33% showed a predilection for collecting their orders in stores.

On the other hand, the mentality of the French when it comes to consuming is changing. More and more products made in France are in demand, in addition to following responsible, local and second-hand consumption trends. This is consistent with the course that consumers in other markets are taking, such as the United Kingdom or Spain, themselves, increasingly aware of their impact on the planet and on the local economy.

The fifty% of French online shoppers acknowledge having bought or sold second-hand items online in 2021. While the percentage rises to 80% when asking if they have ever done it, without being limited to the previous year.

What and where do the French buy online?

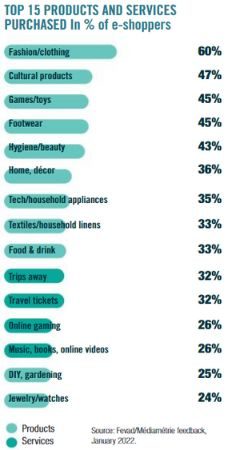

Between the most purchased product categories in eCommerce by the French in 2022 we find: fashion (60%), cultural products (47%), toys (45%), footwear (45%) and hygiene and beauty (43%). It is noteworthy that the food category occupies such a low position, in clear contrast to Spain, where it ranks as the fourth most consumed category online.

Regarding the question of where do the french buy onlinethat the most visited e-commerce website is Amazon not surprising. Second, we find leboncoin, a French buying and selling website that allows you to insert small ads and classified ads. Among its extensive catalog you can find everything from mobile phones, household appliances, fashion to real estate or vehicles.

After this is located cdiscount, website of the Casino Group, owner of several supermarket chains such as Franprix, hypermarkets and restaurants. It is the French Amazon. It is, at the same time, its own store and a marketplace and if you go to its website you will see that it is very similar to Amazon. Finally, in fourth and fifth position respectively appear AliExpress and eBay.

B2B in eCommerce in France

As in other markets, B2B purchases are much more fragmented and are growing as customers get used to (or are forced to) place orders online that were previously made through other channels. After the pandemic, customer-supplier relationships have evolved and more and more companies have been betting on the business digitization. Which has been integrated into all stages, from negotiations to placing orders, reinforcing the B2B eCommerce ecosystem.

Specifically, in 2021 the sales of B2B industrial, specialized, technological or office equipment products, increased by 16% over the previous year.

Image: Depositphotos

Stay informed of the most relevant news on our Telegram channel