![]()

![]()

Today, a company that does not take advantage of social networks to boost its image is left behind. In recent years tiktok It has positioned itself as one of the most valued platforms by users due to the freshness and innovation in its type of content. And, it is that, according to data from Sensor Tower, TikTok managed to exceed 3 billion downloads in the first quarter of 2022of which 14 million downloads correspond to users in Spain.

A study titled Epsilon Icarus Analytics Dashboardprepared by Epsilon Technologies, determined what have been the 10 companies in the financial sector in Spain that have made the most of Tiktok in 2022. To obtain the results, the study analyzed the profiles of social networks (TikTok, Facebook, Twitter, LinkedIn and Instagram) of 42 companies.

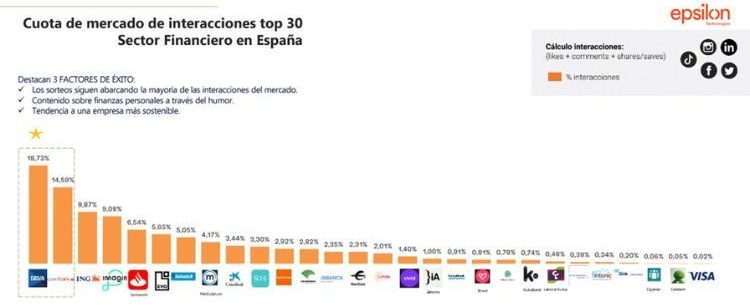

The data collected determined that the 10 companies in the financial sector with greater relevance in social networks in Spain they have been BBVA with 18.73%, Openbank with 14.59%, ING (9.87%), Imagin (9.08%), Santander (6.54%), EVO Banco (5.65% ), Banco Sabadell (5.05%), Mediolanum (4.17%), CaixaBank (3.44%) and N26 (3.30%). The success of these companies in generating likes, comments and shared content was marked by the organization of raffles, information on personal finances and the demonstration of being companies with sustainable trends.

What are the financial companies that are hitting it the most on TikTok

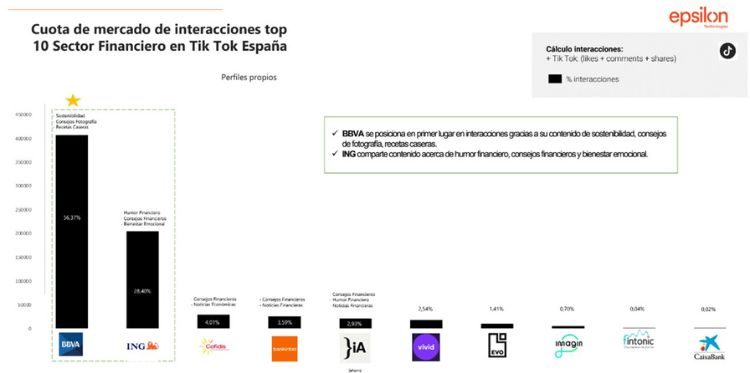

One fact that the study highlights is that the short video platform is positioned as a leader in the generation of interactions, throwing a total of 1 million interactions within said social networkwhich represents a total of 40%.

To generate interactions, companies play with the content that attracts the most attention from the users of said network. In the case of Tiktok, the content shared by the companies focused on the organization of giveawaysgenerate valuable information exposed through the humor and a high tendency to publish content about sustainability.

The company that stayed at the head of the top was the bank BBVA with 56.37%, a percentage that they managed to obtain thanks to their content focused on sustainability, photography tips and homemade recipes.

@bbva

At Christmas we always tend to spend more, so here are tips to save on Christmas shopping! #SaludFinanciera #Navidad #Compras #ComprasNavidad #Dinero #ahorro

♬ Christmas song «Let’s decorate» – 3KTrack

follows him at a distance ING (International Nederlanden Group) with 28.40% obtained thanks to its financial humor, combined with advice and content that appeals to emotional well-being.

@ing_esp

Come on, raise your hand if it happened to you too 👋 #fintok #humorfinanciero #humorentiktok #trends #bizum #ing #somosnomadas #doyourthing

♬ original sound – Complex

Thirdly we find cofidis (4.01%) and their publications on advice and financial news. This same content is what characterizes bankinter (3.59%), which ranks fourth. While humor reappears in the profile of iSavings (2.93%). And, closing the list we find: Vivid, Evo Banco, Imagin, Fintonic and CaixaBank.

Tiktok is not the only social network

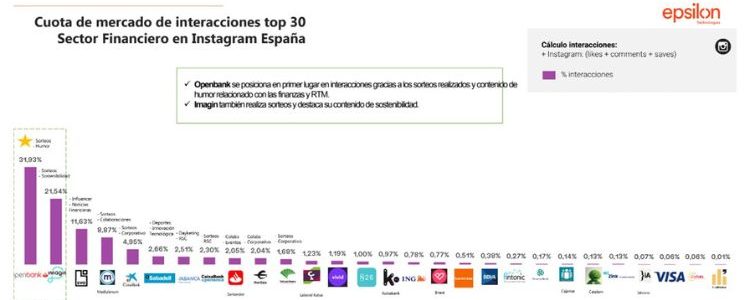

We already made it clear that TikTok is, at the moment, the leading platform for generating interactions, but this does not mean that other social networks do not generate them. Secondly we have Instagram with 29% interactionsthen it is found LinkedIn (19%) with specialized content on Employer Branding and business recognition. And finally we have Facebook (7%) Y Twitter (6%)where there is marketing and humor content.

In the case of Instagram, the companies in the financial sector that lead the ranking are Openbank, followed by Imagin, EVO Banco, Mediolanum and CaixaBank. While in the case of LinkedIn they have been Banco Sabadell, CaixaBank, Bankinter, BBVA and Mediolanum.

Image: Depositphotos

Stay informed of the most relevant news on our Telegram channel