MADRID, 28 (EUROPA PRESS)

Spanish banks have halted the decline in emotional attachment that they have been recording in recent years, according to the 11th edition of the index produced annually by the consulting firm EMO Insights.

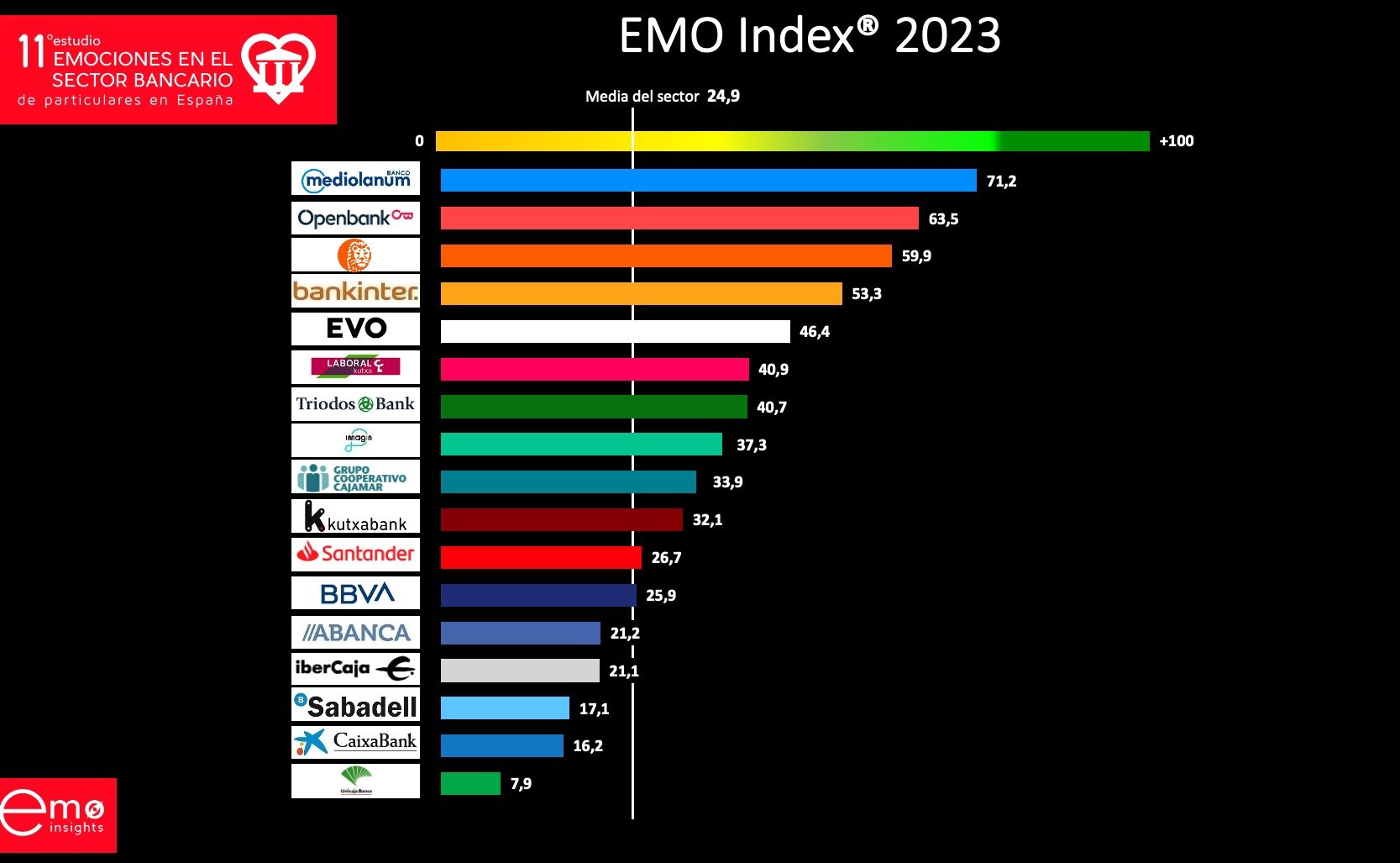

Specifically, the index stood at 24.9 points in 2022, which represents an increase of 1.4 points compared to last year’s data.

Despite the fact that the data is not especially positive compared to other years and sectors of activity, “it represents a turning point as the sharp drop in emotional bonding registered since the arrival of the pandemic came to a halt, since for the first time since 2020 emotions Negatives have not only stopped growing, but are also showing a slight decrease”, stated the operations director of EMO Insights, Gonzalo Martín-Vivaldi.

As added by the CEO of the firm, Elena Alfaro, for each percentage point that the relationship with the customer increases, the market value of a company rises by 4.6 points.

By entities, Mediolanum is the entity with the greatest links in the sector, with a score of 71.2 points. They are followed by Openbank (63.5), ING (59.9) and Bankinter (53.3). On the opposite side, Unicaja stands out with the worst result (7.9), ahead of CaixaBank (16.2%), Sabadell (17.1) and Ibercaja (21.1).

The consultancy has awarded Mediolanum for being at the top of the index, Santander for having the best post-pandemic evolution, Openbank for being the bank that generates the least disappointment, Triodos Bank for the trust of its customers and ING for being the bank with the highest level of recommendation.

Regarding the demographic variables, the study indicates that people between 35 and 55 years of age are the least linked to their bank, although older customers are the ones who have experienced a more pronounced drop in their relationship.

“The evolution of recent years shows that banks are becoming more exclusive, but also less exclusive,” Martín-Vivaldi added.