![]()

![]()

The English Court is working on the development of a new own payment platform, as advanced by El Economista. This would be named ECI Paywhich would have already been registered with the EUIPO (European Union Intellectual Property Office).

The launch of this platform would mean a step forward in the evolution of the payment ecosystem of the Spanish retail giant, something in which it already made progress last year by presenting its new El Corte Inglés Shopping Card.

From what The Economist has reported, the two ECI Pay features that are known at the moment would be: its use to make payments on the web and in the application of El Corte Inglés, and enable a button that allows payment in other businesses with which the giant establishes agreements. Likewise, ECI Pay is only a pilot test at the moment, so it is not ruled out that its final version has a wider range of capabilities and is not limited to financial services.

From Marketing4eCommerce we have contacted El Corte Inglés, but for the moment they have not wanted to give more details about this novelty.

The El Corte Inglés Shopping Card, a classic that has been adapting to the new times

The El Corte Inglés card is a classic that has accompanied its consumers for decadesallowing, like other loyalty cards, to pay in these department stores, have discounts, etc., but also, have access to promotions in other participating businesses.

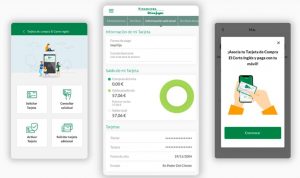

Likewise, the company has been able to make its card evolve in accordance with technological development. Therefore, in 2020Financiera El Corte Inglés launched an app with which you can manage it from your mobile phone in a simple and secure way. The application of the purchase card of El Corte Inglés allows you to make purchases by choosing different modalities, defer payments, check card movements and receipts, have exclusive promotions, and even request the Purchase Card from those who do not yet have it.

Later, in 2022, a card change was announced, presenting a new one that would replace the old ones. And with it came new advantages, such as the ability to put off shopping between 75 and 2,000 euros in three months without interest. On the other hand, this new card included two differentiated lines of credit and with different limits, one for purchases at the retail giant and associated businesses, and another for making purchases at other businesses, including those of the Repsol, Campsa and Petronor.

Photo: Depositphotos

Stay informed of the most relevant news on our Telegram channel